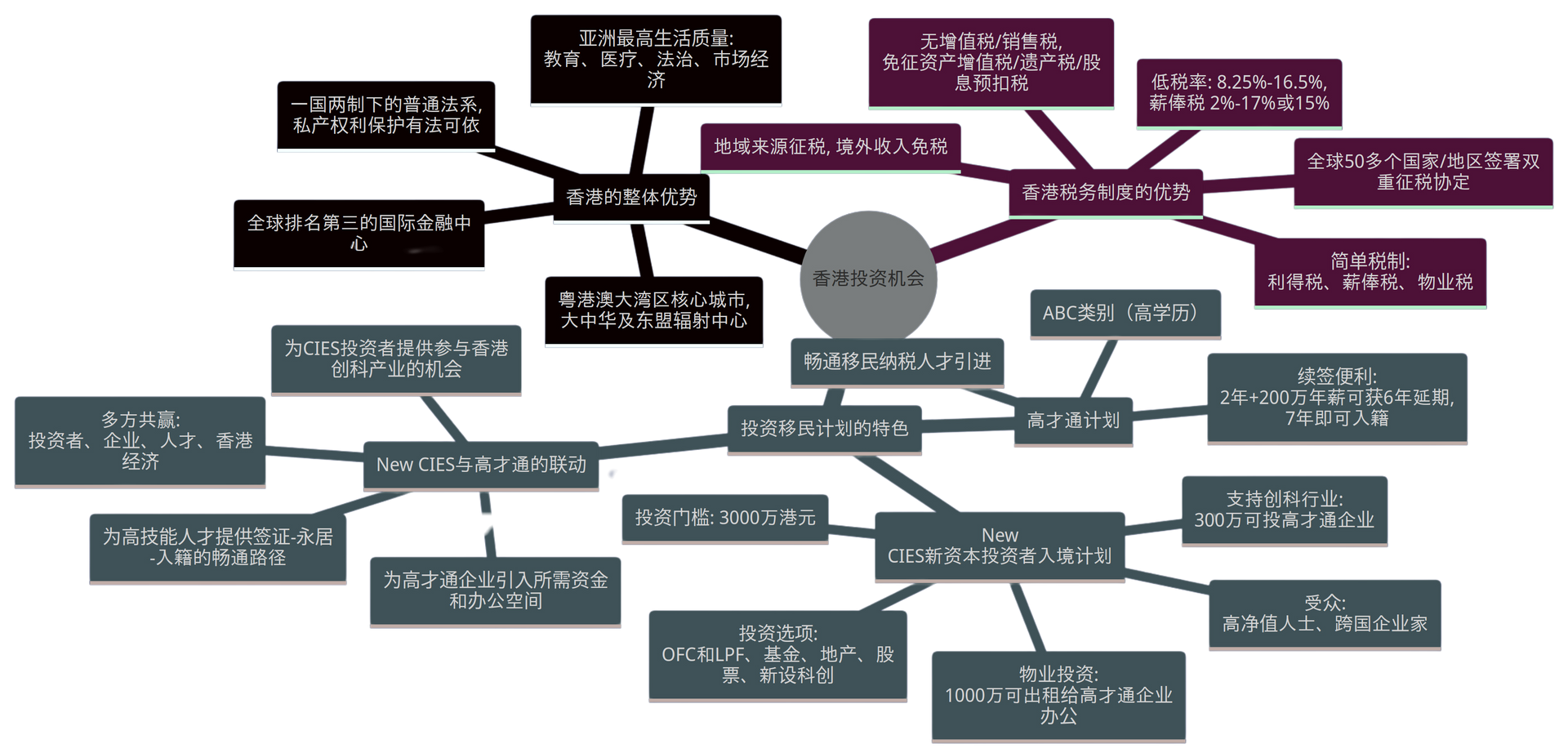

Hong Kong's overall advantages

01

Under the common law system of "One Country, Two Systems", the protection of private property rights is based on law

02

The core city of the Guangdong-Hong Kong-Macao Greater Bay Area, the radiation center of Greater China and ASEAN

03

The world's third largest international financial center

04

Ranked among the top three in the world for business, business environment and operation

05

The highest quality of life in Asia: education, medical care, rule of law, market economy

Low Tax Rate:

- Profit tax 5%/8.25%-16.5%,

- Salary tax 2%-17% or 15%

Advantages of Hong Kong’s tax system

- Simple tax system: profit tax, salary tax, property tax

- Taxation based on territorial sources, tax exemption on foreign income

- No VAT/sales tax, no capital gains tax/inheritance tax/dividend withholding tax

- Double taxation agreements signed with more than 50 countries/regions around the world

New CIES New Capital Investor Entrance Scheme:

High Talent Program

- Investment threshold: HK$30 million

- Investment options: OFC and LPF, funds, real estate, stocks, new science and technology innovation

- Audience: High net worth individuals, multinational entrepreneurs

- Supporting the innovation and technology industry: NT$3 million can be invested in high-talent enterprises

- Property investment: 10 million can be rented out to Gaocaitong Enterprise Office

- ABC category (high education)

- Facilitate the introduction of immigrant and taxpayer talents

- Extension convenience: 2 years + 2 million annual salary can be extended for 6 years, and naturalization can be obtained in 7 years

New CIES and Gaocaitong Collaboration

New CIES and Gaocaitong have formed a positive interaction in attracting funds, introducing talents, and developing innovation and technology. The linkage effect of the two will be far greater than the effect of a single plan. This will create an ideal ecosystem where capital, projects, and talents can gather, reduce costs, and stimulate innovation vitality.

New CIES and Gaocaitong Collaboration 1+1 > 2

Providing CIES investors with opportunities to participate in Hong Kong’s innovation and technology industry

Gaocaitong enterprises can introduce funds and office space from CIES investors

Highly skilled talents can enhance the competitiveness of CIES investors’ companies

New CIES investors can invest in high-talent enterprises and share the growth dividend of Hong Kong's innovative industries. At the same time, the office properties they purchase can also provide high-talent enterprises with the required operating space. High-talent enterprises can accelerate their development with the funds and resources of New CIES investors, and use the outstanding talents introduced by high-talent to enhance their core competitiveness.

New CIES provides "money" for Gaocaitong, and Gaocaitong provides "people" for New CIES. The two complement each other and work together. This multi-dimensional linkage effect will far exceed the effect of a single plan. Under the synergy of New CIES and Gaocaitong, Hong Kong is accelerating the construction of a virtuous cycle of "capital-project-talent". Investors, enterprises and talents each get what they need and jointly draw a grand blueprint for Hong Kong's economic take-off.

The New CIES and High Talent Scheme launched by the Hong Kong SAR Government have formed a powerful synergy in attracting investment and talent. On the one hand, New CIES provides a convenient investment immigration channel for high-net-worth investors, and on the other hand, the High Talent Scheme paves the way for high-end talents to work and settle in Hong Kong.

W

Hong Kong’s advantages as a family office and asset management company

- Connect with the global financial market and provide diversified investment channels

- Hong Kong is a leading international financial center with high connectivity to major global financial markets. This provides family offices and asset management institutions with a wide range of investment channels. They can flexibly allocate various global assets according to their own needs and risk preferences to achieve portfolio diversification. Hong Kong's mature financial infrastructure and efficient trading platform also facilitate asset allocation.

t

- Facilitate cross-border capital flows and inheritance, and reduce tax costs

- Hong Kong has a simple and low tax system, with free and convenient capital inflow and outflow and no foreign exchange control, which greatly facilitates the cross-border operations of family offices and asset management institutions. At the same time, Hong Kong has signed double taxation agreements with the mainland and many countries, which can effectively avoid double taxation and reduce the tax burden. For family wealth inheritance, Hong Kong also provides tools such as trusts, which can not only achieve efficient and smooth wealth transfer, but also enjoy the dividends of tax havens.

- NEW CAYMAN IN ASIA

Hong Kong’s advantages as a family office and asset management company

s

- A good legal and regulatory environment provides strong protection for private wealth.

- Hong Kong has a sound legal system, especially in terms of the protection of private property rights, the law provides solid protection. For high net worth individuals, this means that their wealth can be effectively protected from improper infringement. At the same time, Hong Kong's regulatory agencies, such as the Hong Kong Securities and Futures Commission, also have a sound system for regulating the asset management industry to ensure that the market is fair and orderly and that the interests of investors are protected.

O

- Professional wealth and asset management services, such as trusts, funds, insurance, etc.

- Hong Kong is home to a large number of leading international wealth and asset management institutions that can tailor professional and personalized wealth management solutions for high net worth clients. A wide range of financial products such as trusts, private equity funds, insurance, etc. can meet the diverse needs of family wealth preservation, appreciation and inheritance. These institutions not only have strong strength and rich experience, but also have professional and dedicated teams dedicated to creating long-term and stable returns for customers.

Advantages of Hong Kong’s business environment

- Efficient and transparent administrative approval process, ranking among the best in the world

- A sound intellectual property protection system encourages innovation

- Complete infrastructure and international professional service support

Recommendations and next steps

Hong Kong Pulse, Global Vision

- Regularly provide information and investment opportunities in Hong Kong and international markets

One-stop worry-free, easy settlement

- Provide one-stop services for company structure, taxation and other landing in Hong Kong

- Combine New CIES and Gaocaitong to develop a personalized investment immigration plan

Tailor-made, integrating dual advantages

Family wealth, Hong Kong deployment

- Assess family wealth allocation needs and provide Hong Kong asset allocation recommendations

about Us

Goals

- set up my own funds and help immigrate to HK and for private wealth planning

- grow venture investing portolio companies and mobility and taxaction status

- synergy and linkages with listed corporates and better use of equity/ capital

- personal/ peers relationship

Objectives

- Grow market share, increase our AUMs of the fund/Asset management market.

- Boost customer satisfaction, make customers happier with our services.

- Get more recognized, make more people know about our brand.

Funding Plans

Objectives

Immigration investment account portfolio

- Chip in

- Synergy

- Long Term& Sustainability

- the safest Fixed Income injection:(e.g. soverignty debts; credit debts; corporate debts)

- HK listed convertible bonds/stocks injection (shareholders)

- real estate/ LPF/OFC/BTC injection

- venture investment IN&OUT

- others: maybe insurance linked

77%

37%

SAMPLE PORTFOLIOS

QUESTIONS

Thank You